Britain is going for another referendum on June 23rd to decide whether to accept the EU reforms or leave the EU. On the street, people are referring to the referendum as the Brexit and the real question is: Will it really happen?

I really don’t think so.

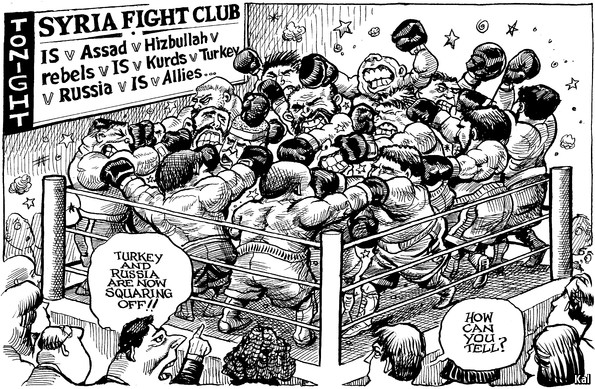

Since David Cameron declared that he would re-negotiate the relationship with the EU in 2013, I see the whole process as a well-rehearsed theatrical play. There are some good cops and bad cops in the play, but the agenda and the outcome are very well planned ahead.

The good cops are the ones who are very happy with the “special status” obtained from the EU after hard negotiations led by David Cameron.

This group is very happy, since concessions have been obtained and the UK is now a “privileged” member of the union. Of course, nothing should be shown as having been won easily at someone else’s expense, so there the bad cops kick in and the theatre starts.

The other group of people are still not really happy with the EU after the “special status” and they want the UK to leave the EU regardless.

Within this group, there are two distinct sub-groups: genuine politicians who really want the UK to leave the EU, since they are populist politicians, without calculating the damage to the UK; and the others, there to play the bad cop for the drama or for their own personal interest.

Currently half a dozen cabinet members are in favour of leaving the EU; however, most of the cabinet members want the UK to stay in Europe. Boris Johnson’s decision to campaign to leave the EU was an eye opener for the political arena as well as the financial markets.

Sterling dropped from 1.44 to 1.39 against the US dollar.

If the referendum result is to leave the EU in June, David Cameron will be a definite loser and, since Boris Johnson is the strongest candidate for the Tory leadership, the probability that he will win the most desired seat earlier becomes significantly higher.

It is good to remember that this is not the first time that the British public has voted to stay in or leave the EU, and the Conservatives have a good record of being split on important issues, going back to the late nineteenth century and, more recently, the 1990s, when its own MPs prepared the end of Thatcher’s eleven year premiership. In other words, they opened the door for 13 years of Labour leadership.

The UK is currently the world’s fifth biggest economy and it is the fifth largest spender on defence. The EU takes almost half of the UK’s exports and the UK takes less than ten per cent of the EU’s. A decision to leave the EU will definitely harm both sides and a Brexit will create a more dominant Germany in the EU, which I am not sure many of the member states will be happy to see.

Arguably, it may open the door for other members to re-negotiate their status with the alliance, and the models of Norway or Switzerland could be preferable for future members rather than joining the union.

One may discuss the capabilities of the UK in the current world, but nobody can ignore that Britain is still a top notch leader when it comes to politics.

Why would such a political genius open the door for another referendum for Scotland to leave the UK, financial companies to relocate their headquarters and a huge volume of transactions to move out of the UK, especially at a time when “special status” has already been granted from the EU, thanks to Prime Minister David Cameron?

It is simply another well acted piece of theatre.

All the best from Singapore.

Sukru Haskan

Twitter: @sukru_haskan