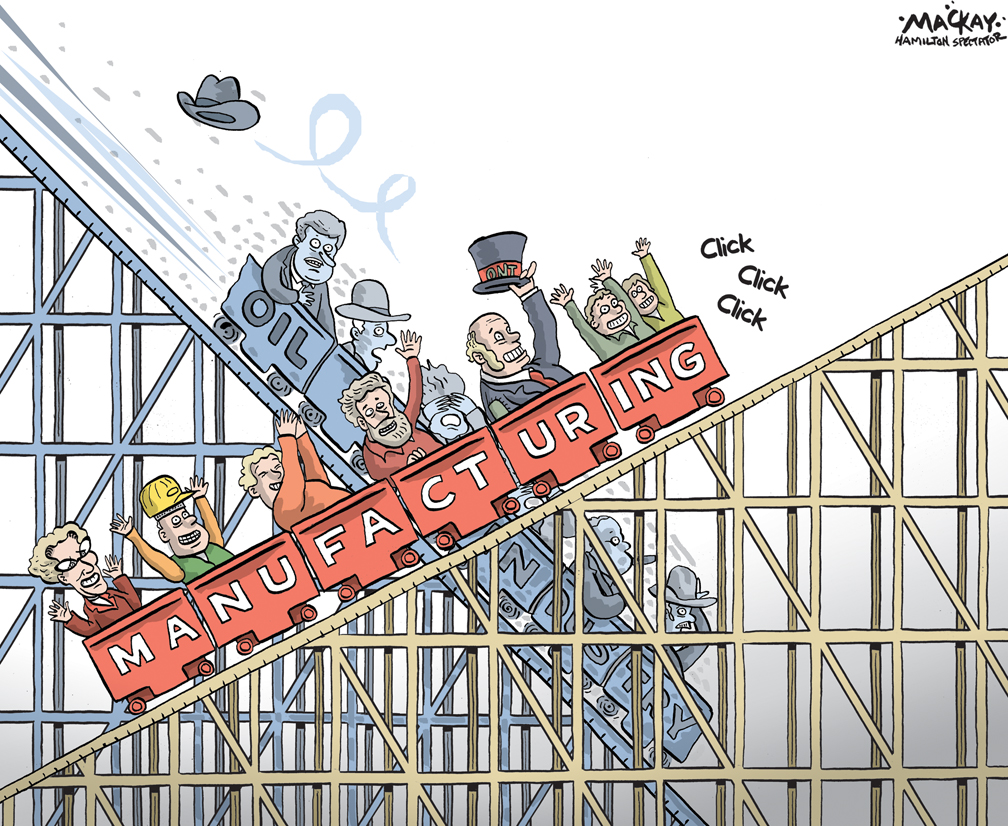

Absolutely, the declining oil price is a good thing!

Not only oil, but a price plunge in all types of commodity is good in the long term…

In the short term, it may look dreadful. There may be difficulties in terms of keeping up with the debt repayments of oil rich countries and companies, expanding current account deficits and even bankruptcies.

All of this could be very painful—so why then is it a good thing?

Earning money from commodities is not like a having a proper manufacturing or service sector which you make money out of. A commodity is a natural resource and it is abundant there just out of pure luck.

In other words, there is no real hard work behind it.

In order to set up a manufacturing company, you need a lot of things to be in place and, most importantly, it needs hard work. The same goes for the service sector. For instance, let’s take the example of the financial sector.

This requires a wealth of knowledge that people acquire not just through education, but also through valuable experience.

Can you imagine how many years it took to build the New York or London financial centres to where they are now?

Just remember the wealth of experience and intellectual capacity that these financial centres are sitting on—like JP Morgan, the Rothschild family, the Warburg family, the Rockefellers, and many more…

When something is given and you know how to extract the natural resource, you are like a third generation rich kid whose parents had a lot of real estate which you inherited. You continue to receive the rent payments from your tenants, but how many of you will really think about how to improve or develop new skills?

There are always outliers who can take things further, but mainly it is fair to say that this is not the case.

Then, what happens most of the time to third generation companies/wealth?

Nearly 60% of the time, a family’s money is exhausted by the children of the person who created the wealth, according to Roy Williams, president of wealth consultancy The Williams Group. In 90% of cases, it’s gone by the time the grandchildren die.

Source: http://money.cnn.com/2014/06/25/luxury/family-wealth/

A commodity price plunge will push countries and companies to reform themselves. More importantly, countries will need to adapt to the current environment to survive, and companies will try to be more innovative to survive.

The oil price decline will mean more reform, more innovation, more democracy and a better future!

Last but not least, there is a very nice article on Chatham House regarding commodity rich countries. The article talks about the resource curse. You can look at:

https://www.chathamhouse.org/publication/resource-curse-revisited

p.s: This week will be a very important week for me and for my family. I will be a father for the first time! Wish me good luck!

All the best from Singapore.

Sukru Haskan

Twitter: @sukru_haskan