Hardware, software, capital and regulations are the key challenges for most of the fintech startups and regulation remains the most important external factor that could potentially lead the whole idea to be stillborn if not correctly assessed and addressed.

When the regulators are not very cooperative and do not want to take any risk, then it is almost impossible for the fintech startups such as SmartDeposit to operate and acquire clients.

The selection of the right jurisdiction for your startup will affect the performance of your company tremendously, especially at the beginning.

Imagine a regulatory environment that bans you from operating without a licence and treats you as a proper financial institution. As soon as you are treated as a financial institution rather than a fintech company, capital requirements and red tape will kick in, which will not only increase the cost of your doing business tremendously, but also disadvantage you in the competition from the very start since you must now act like a proper bank whilst you do not have millions of customers and you don’t have any capital nowhere near as any bank.

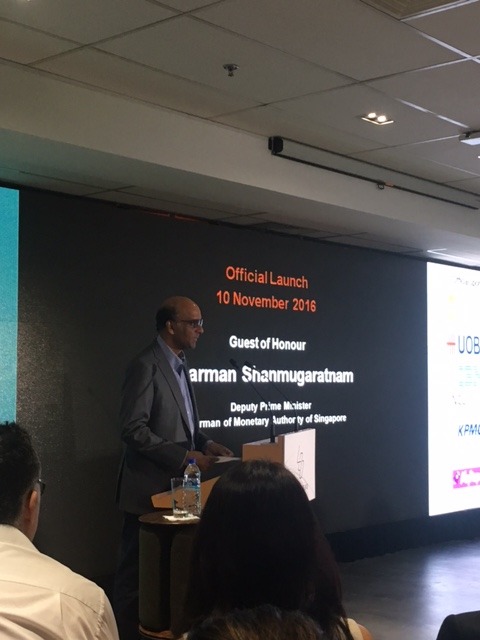

In this respect, Singapore is a great place to set up the venture since the regulator is willing to help innovative companies and they are willing to regulate only when they reach a critical mass for the industry. In addition, regulators in Singapore are communicative and have specific employees assigned to the fintech industry. I would think the only and very important disadvantage is the size of the market since it is a small city state country. Regardless, it is a great and the best option for SmartDeposit to take off due to its regulatory environment.

Since Singapore is a gateway to South-East and South Asia, a good reputable take-off could enable the company to benefit from accessing other mass markets such as Indonesia, Malaysia, Thailand from Singapore. Moreover, access to capital and VCs in Singapore is relatively easy and the region is booming not only economically, but also in many other aspects.

London is a good alternative with an established ecosystem. In contrast, New York would be difficult in terms of licensing issues and other regulatory hurdles.

The regulator in the UK, FCA, is also supportive of the fintech industry and the establishment of Level 39 in the financial hub of London, Canary Wharf, is an advantage.

When you acquire the critical mass in terms of clients and deposits, you will need to leave your home country (e.g. Singapore) to find new customers to exponentially grow and this will ensure you cooperate with more than one regulator. But since you now have a critical mass from your home country, it would be much easier to go out and try to look for new markets, and most importantly, you have more negotiation power now than at the start.

All the best from Singapore.

Sukru Haskan

Twitter: @sukru_haskan