The world is changing rapidly and we have been living two types of lives for some time now; physical and digital.

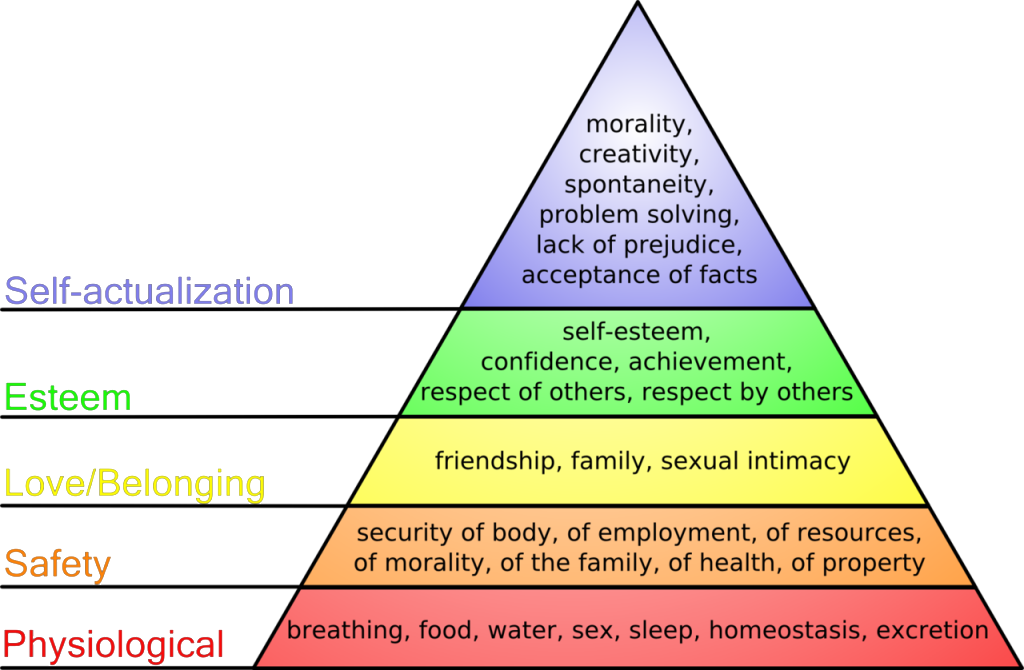

Our physical lives are simple and also complicated. Simple because we follow our basic needs and wants such as sleeping and drinking. These are our instincts. Complicated because we interact with many individuals during our lives and we have motivations, emotions and egos.

Our digital lives are complicated and also simple. Complicated because it is new and many of us are not really aware of it. Simple because everything is accessible, trackable and fast.

Our digital lives are becoming important as they start overcoming our physical lives and this transformation has a huge impact not only on human beings but also on the corporate world.

What are your Code Halos?

In our digital lives like our physical lives, we are leaving traces behind us.

These traces in the digital world are our CODE HALOS! It is the meaningful version of BIG DATA!

Since human brain is programmed to forget, we simply forget things but computers DO NOT!

So Code Halos are our digital lives’ track record that is analyzed and made ready for us to make our lives easier.

Nowadays Code Halos are being used by many companies such as Amazon, Google and Facebook. It is the DNA of what you like, who you like and what inspires you.

Thanks to Google Analytics, even I am tracking your behavior on this blog…. e.g: How many minutes you spend on each page, which countries and cities you are from, your keyboard default language, etc.

This valuable information will determine my future articles to get more traction from you.

Whilst these are all happening at full throttle, there are people resisting change.

So what will happen to those status quo keepers?

- If it is a person, they will be unemployed.

Just like what happened to blue collars in late 1900s, digital world will get many people out of the workforce. The difference is; it will hit white collar employees this time. - If it is a company, it will simply not survive.

Companies that are not building their own clients’ code halos are losing out today. Just like Kodak, Nokia or CompuServe did…

Like anything, Code Halos also bring its own challenges. Recently Ashley Madison clients’ data has been stolen and very private information is now public and most recently a HIV clinic in the UK released its list of their patients by mistake. Data safety and using it for genuine purposes is crucial.

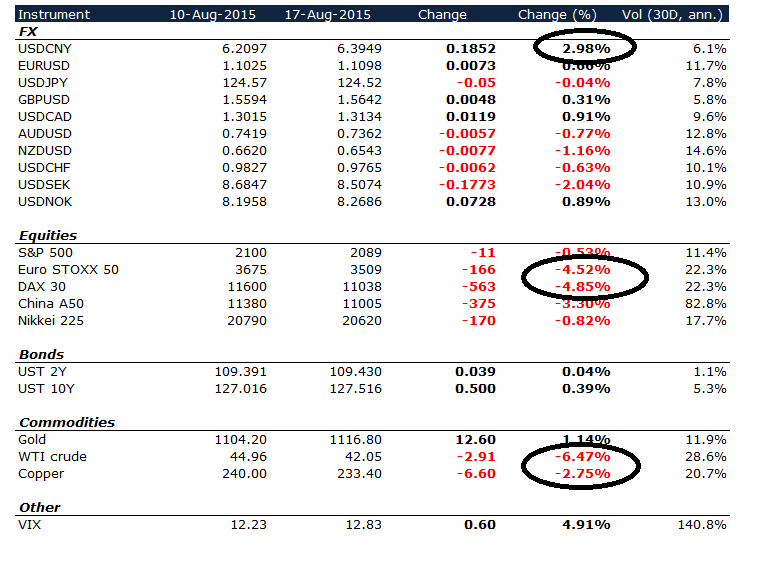

As a banker, I am aware that banking will also change completely. It has already started with retail banking initially and it will follow with other segments of banking slowly.

There will be no need for physical branches. This will create huge opportunities for every bank and internet companies that are allowed to collect deposit/give loans to compete in geographically large countries such as India, Australia and Russia.

Alibaba has started collecting deposits in China and Apple has introduced Apple Pay to facilitate payments. You do not really have to be genius to predict that these companies may kick some banks and financial intermediaries like Visa and Mastercard out of the game in the coming years.

We all have revenue production pressures and results do not always come very quickly. Patience and willingness to adapt will be the key factors that will determine if traditional banks and financial intermediaries will stay in this game.

Book recommendation: This article is largely inspired after reading the book, Code Halos written by Malcolm Frank, Paul Roehrig and Ben Pring.

Best from Singapore,

Sukru Haskan

Twitter: @sukru_haskan